YOU CAN DONATE STOCK TO HOME SWEET HOME!

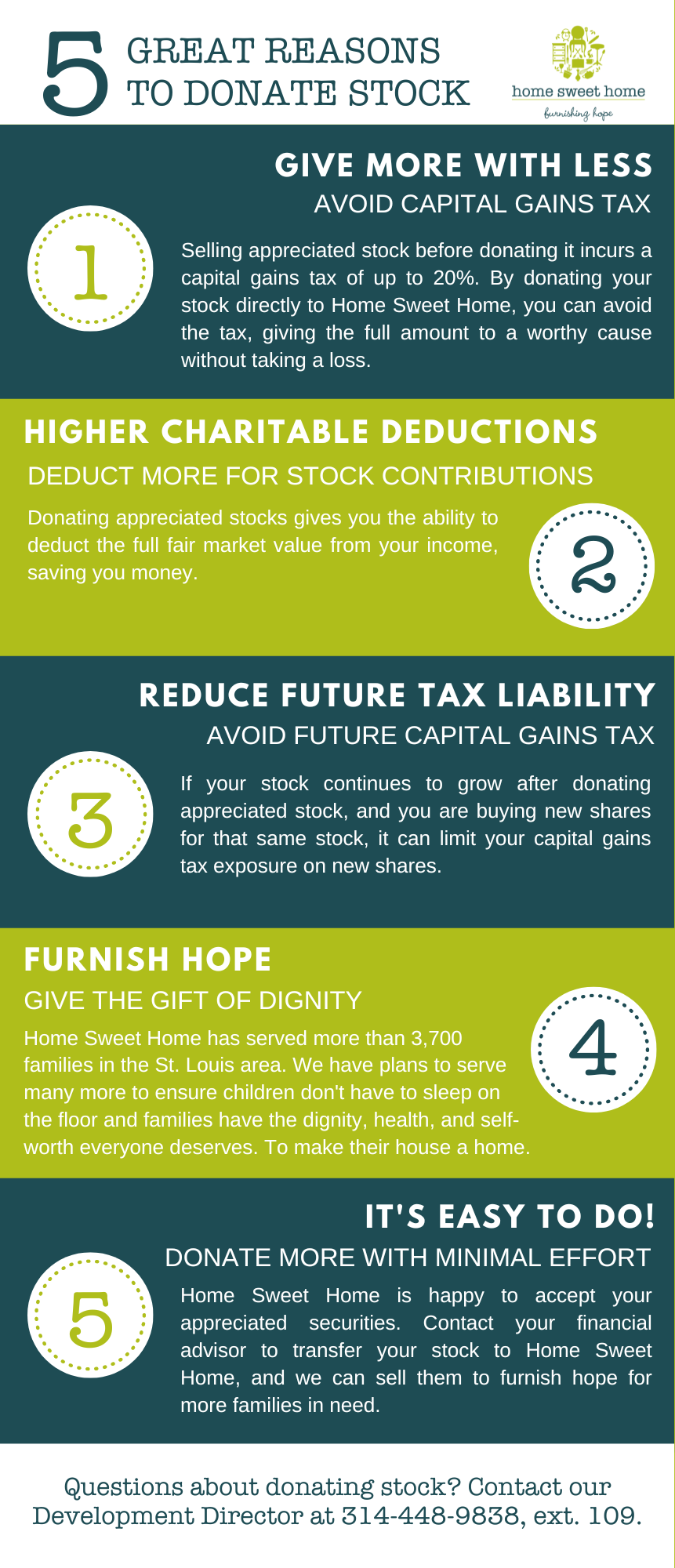

You can make an even bigger impact by donating long-term appreciated securities, including stock, bonds, and mutual funds, directly to Home Sweet Home. Compared to donating cash or selling appreciated securities and contributing the after-tax proceeds, you may be able to increase your gift and your tax deduction. Consult with a financial advisor to determine what makes the most sense for you.

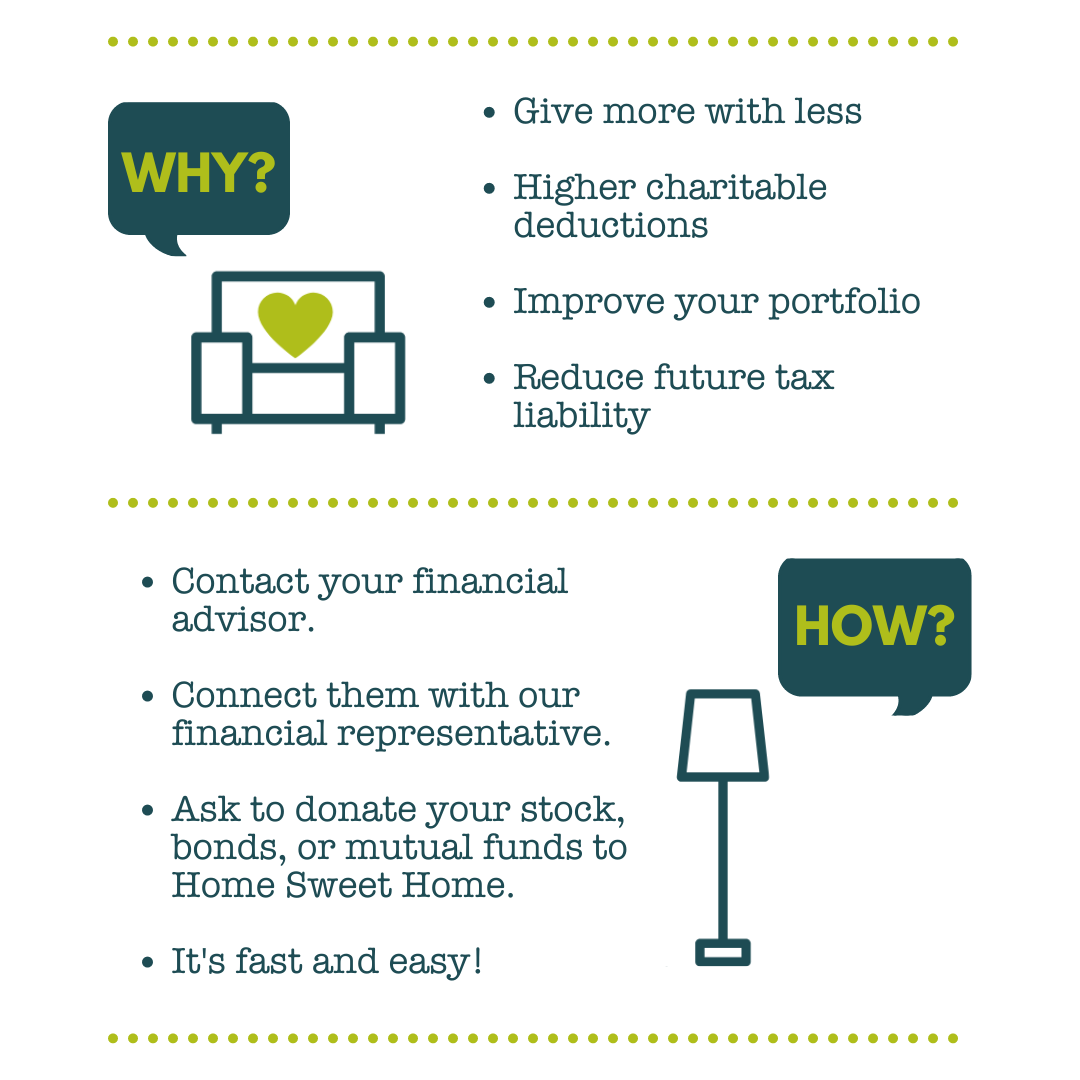

HOW DOES IT WORK?

It’s simple and easy. When donating stock to Home Sweet Home, you’ll generally take a tax deduction for the full fair market value. And because you are donating stock, your contribution and tax deduction may instantly increase over 20%. If you prefer to donate bonds or mutual funds the same benefits apply. Make a gift only once a year.

Giving stock often provides the opportunity to maximize your gift to Home Sweet Home because there are no capital gains taxes to pay and your gift is tax-deductible.

Questions about donating stock to Home Sweet Home?

Contact our Development Coordinator, Corlena Hall at corlena.hall@homesweethomestl.org, 314-448-9838 ext. 111.